20 Sep Get Real About Your Business and Avoid Reality-Show-Makeover Syndrome

Content

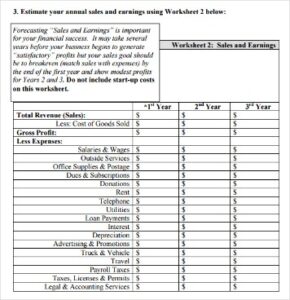

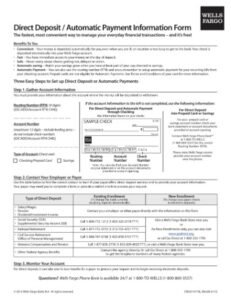

- Five steps for payroll processing

- What should I read for business?

- How Does Behavioral Finance Differ From Mainstream Financial Theory?

- The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses by Eric Ries

- Entrepreneur Habits Holding You Back from Business Success

Process automation enhances internal controls while enforcing standardization to improve the quality and accuracy of financial data. They have the time to apply not just their knowledge and expertise, but also their creativity and intelligence. What if you could be more productive with fewer resources and less overtime while improving the quality of your work?

- We’re a full service firm focused on people, process, partnership, performance and business transformation.

- Repeatedly I see the same primary reasons for business failures – all which are fixable.

- Psychologist Peter Gollwitzer showed in a study that having a strategy to deal with those situations works like a charm.

- If that’s not possible, consider requesting an increase to your credit limit or paying your credit card bill twice per month.

- Human Resources Hire, onboard, manage, and develop productive employees.

- Plus you can use this time for building maintenance, vacations, and strategic planning for the next busy season.

Fine-tune and adjust the spending as needed after each month. Once you’ve got a sense of where the money goes, it’s time to tighten up. All cutbacks should start with items you wouldn’t miss or habits you should change anyway—like reducing your fresh food purchases if you find ingredients spoiling before you can eat them.

Five steps for payroll processing

Instead, choose one at a time, give yourself 30 days of practice, and then move on to the next. In a year, you could be flooded with profitable, loyal customers. People don’t realize that libraries have loads of valuable information for everyone, including small business owners or individuals hoping to start a small business in the near future. Everyone knows the rescue-the-bad-business reality shows — “Bar Rescue,” “The Profit,” “Hotel Impossible” — and many viewers are hooked on watching Cinderella stories unfold. But all these shows have the same equation, with some rogue employees and bad finances thrown in for good measure. The result each time is an astounding makeover complete with new decor, top-of-the-line equipment and a new branding identity.

- Some people know how to figure how much they’ll get in a refund as well as how to adjust this figure through changes in payroll withholding throughout the year.

- You just have to figure out which tactic or strategy will work best in each particular situation.

- In other words, they’re far more likely to try to assign a higher priority to avoiding losses than making investment gains.

- A solid foundation with strong controls and processes allows for growth and expansion.

- Midsize Businesses The tools and resources you need to manage your mid-sized business.

So be sure to be supportive and understanding of their journey. Offer encouragement when they feel discouraged and praise them for their hard work. Another way to encourage people to change their bad habits is by tracking their progress.

What should I read for business?

With QuickBooks® Online you can review a list of all open invoices and send a batch reminder to all customers who haven’t paid. Look at how much your biggest clients pay you on an annual basis. Give them a proposal that lists the services they typically use over the course of a year. Include a scope document that defines what they get for that monthly fee and what’s out of scope and covered by a pre-approved work order. A retainer program makes it easier for clients to budget and smooth out their cash flow.

However, the winter was slow so they developed a winemaking course for people to learn how to make wine. Every seasonal business can make money in their offseason. An example of this tactic are swimming pool stores, whose Top 5 Bad Accounting Habits That Could Be Holding Your Business Back busy season is summer, that during the winter sell Holiday decorations. Examine every team member’s job description and their suitability including personality, level of competence, and contribution to your bottom line.

How Does Behavioral Finance Differ From Mainstream Financial Theory?

It doesn’t make sense to have $100 in a savings plan if you are fending off debt collectors. Your piggy bank will have to starve until you can find financial stability. https://quick-bookkeeping.net/ It’s difficult to predict how much money you’ll need in every category of life; a new job may necessitate a wardrobe change and your clothing budget may not cut it.

What bad habits do you have that you should avoid so that you can be financially fit?

- Ignoring bills.

- Maxing out credit cards.

- Not contributing to your 401(k) plan.

- Spending Blindly.

- Not having an emergency fund.

- Living beyond your means.

- Stop playing money mind games.

If Facebook is where your friends are, Twitter is where your top notch experts reside. If you have a company Facebook page and you’re not “talking” to your customers there, you are missing out on FREE advertising. Every time someone “likes” your page, your posts end up in their newsfeed –FOR FREE.

It shows how many customers were called or sent reminders, so you get an early warning if your collection efforts are faltering. A bad collections process will lead to unnecessary cash flow problems. Pursuing a continuous improvement mindset and looking for new and better ways of doing things is much more gratifying and creates opportunities for you to impact the bottom line. Strive to exceed strategic and operational goals by contributing to the creation of a high-performing and sustainable organization. Along with personal health comes the necessity to feel good about yourself.

Well, if you follow the guidelines here you’ll save more than your average trip to the store for groceries or personal items. As the best Atlanta CPA firm, this is exactly what we can do for businesses and individuals with our tax planning services. We hope these suggestions help you break your bad habits today. Getting an upfront payment that covers your out of pocket costs will completely change your company’s cash flow.

No Comments