03 Feb Owners Equity Learn How to Calculate Owner’s Equity

Content

Treasury Stock which represents the value of shares repurchased by the company. As seen above, The Statement of shareholders equity is normally prepared in vertical format, i.e. the equity components appear as column headings and changes during the year appear as row headings. A Corporation issues ownership shares called Capital Stock – so it is common to see the Statement or Owners Equity be referred to as Statement of changes in Stockholder’s Equity in bigger Corporations. The theory behind the Statement of Owners Equity is to reconcile the opening balances of equity accounts in a company with the closing balances and present this information to external users. While the ending balances of owner’s equity are mentioned in the Balance Sheet, it is often tough to ascertain what caused the changes in the owner’s accounts, especially in bigger corporations.

- Using the owner’s equity formula, the owner’s equity would be $40,000 ($50,000 – $10,000).

- This statement of owner’s equity shows how John’s capital in the business changed over the year.

- Both the amount of owner’s equity and how much it has changed from one accounting period to another offer insights into a business’s financial condition.

- Assets, liabilities, and subsequently the owner’s equity can be derived from a balance sheet, which shows these items at a specific point in time.

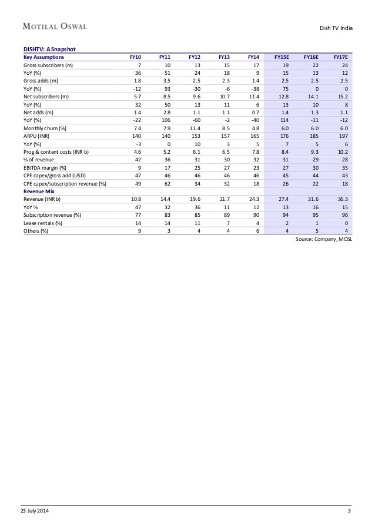

With the above in mind, potential lenders generally consider a total debt-to-equities ratio of 0.40 or lower as “good,” and a long-term debt-to-equities ratio of 0.30 or lower as good. As the company’s debt-to-equities ratios increase above these values, firms have more trouble acquiring new loans. Another debt-to-equities ratio, long-term debt to stockholders equities, is less conservative than the previous ratio. It is, however, more properly a measure of leverage because the debt figure contains only debt to lenders or long-term debt.

Owner’s equity vs. shareholders’ equity

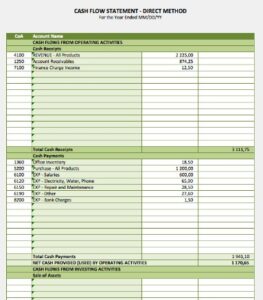

The statement includes all ownership changes, including owners’ contributions, profits, and losses. Corporation, accounts like retained earnings, treasury stock, and additional paid-in capital could also be included in your balance sheet. Equity accounts on a balance sheet—liabilities and owner’s equity are usually found on the right side, and assets are found on the left side. Owner’s equity is equal to a company’s total assets minus its total liabilities.

However, their claims are discharged before the shares of common stockholders at the time of liquidation. The value of owner’s equity is derived in part from a company’s assets, but owner’s equity is not itself an asset. Owner’s equity is calculated as the total value of a company’s assets minus the company’s liabilities. A company with higher assets than liabilities will show a positive owner’s equity. Other factors can contribute to a higher or lower sales price, too — like a company prioritizing a quick sale to stave off an impending bankruptcy. Because of the subjectivity that can accompany values like “brand strength,” a company’s market value may be higher than the owner’s equity.

Building Equity (Net Worth, Book Value)

Owner’s equity can be used to evaluate a business’s performance and prospects. Increases in owner’s equity from one year to the next may indicate a business is well-managed and succeeding. Decreases in owner’s equity may indicate the owner needs to inject more capital into the company. These are profits that What Is Owners Equity? are reinvested in the company rather than being distributed to the owner or owners as dividends or used to pay down debt. Retained earnings can grow to become a large part of owner’s equity over time. The formula for calculating owner’s equity involves subtracting total liabilities from total assets.

What is owner’s equity examples?

In simple terms, owner's equity is defined as the amount of money invested by the owner in the business minus any money taken out by the owner of the business. For example: If a real estate project is valued at $500,000 and the loan amount due is $400,000, the amount of owner's equity, in this case, is $100,000.

Alex and Bob contributed an additional $15,000 each to the business, and they made a draw of $10,000 each for personal expenses. At the beginning of the year, John’s capital balance in the business was $100,000. During the year, the business earned a net income of $40,000 and incurred a loss of $20,000.

What is a statement of owner’s equity?

It may also be known as shareholder’s equity or stockholder’s equity if the business is structured as an LLC or a corporation. The Statement of Owner’s Equity helps users of financial statements to identify the factors that caused a change in the owners’ equity over the accounting period. In small, privately held companies it is not unusual for owners to withdraw funds from the company from time to time. For this, they use a withdrawal account takes funds directly from an Owners equity account. Such an account is an Equity “contra account,” sometimes called a “drawing account.” Withdrawals through this account reduce Owners equity, of course.

- Midsize Businesses The tools and resources you need to manage your mid-sized business.

- The assets are shown on the left side, while the liabilities and owner’s equity are shown on the right side of the balance sheet.

- Full disclosure requires that all relevant information be disclosed in the financial statements, including the statement of owner’s equity.

- By retaining earnings, a company can finance its growth without having to rely on external financing, such as debt or equity financing.

Owner’s equity represents the owner’s investment in the business minus the owner’s draws or withdrawals from the business plus the net income since the business began. For investors who don’t meet this marker, there is the option of private equity exchange-traded funds . Owner’s equity can be calculated by summing all the business assets and deducting all the liabilities . Owner’s equity is essentially the owner’s rights to the assets of the business. It’s what’s left over for the owner after you’ve subtracted all the liabilities from the assets.

How to Increase or Decrease Equity

Subtract total liabilities from total assets to arrive at shareholder equity. Equity is important because it represents the value of an investor’s stake in a company, represented by the proportion of its shares. Owning https://kelleysbookkeeping.com/ stock in a company gives shareholders the potential for capital gains and dividends. Owning equity will also give shareholders the right to vote on corporate actions and elections for the board of directors.

Note- Debentures will not form part of owner’s equity as it forms part of external liabilities. Owner’s equity is a representation of several components within it. But we will specify the most famous method of calculating the owner’s equity. Owner’s equity is the set of account balances that have cumulative account balances of contributions to date, withdrawals till date, and earnings till date.

No Comments